Welcome to #NU Cochrane: Excellence in London Property Development

- Nick Jeffries

- May 18, 2024

- 5 min read

Introduction

#NU Cochrane is a distinguished boutique development and investment company specialising in the Prime London residential property market. With a commitment to delivering a personal approach, we leverage unrivalled relationships with suppliers, private investors, and property establishments to offer full-service bespoke prospects. Our mission is to create valuable investments for our joint venture partners, drawing upon our extensive knowledge and experience in the prime areas of London.

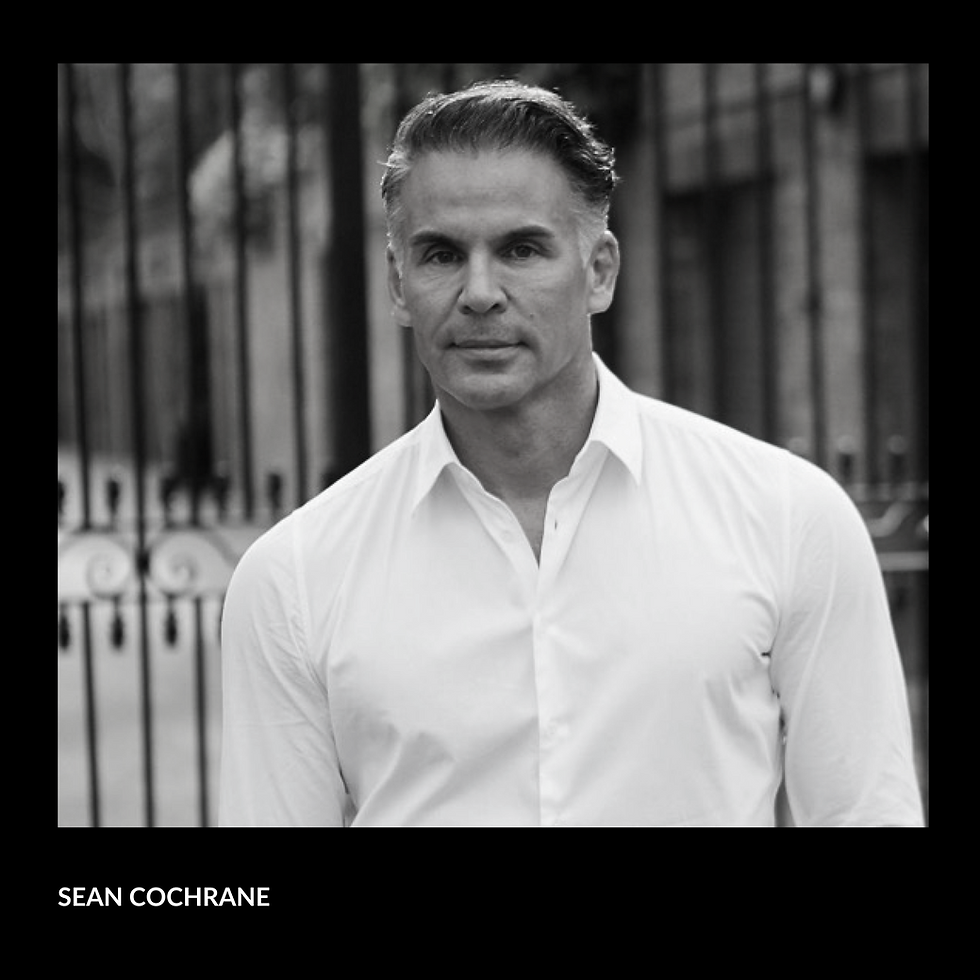

Established in 2011, #NU has achieved significant growth, engaging in both on and off-market trades totalling more than £50 million. Our reputation is built on the excellence, efficiency, and meticulous attention to detail that our clients’ visions demand. Under the leadership of Nick Jeffries and Sean Cochrane, a multi-award-winning designer, we assemble dynamic teams consisting of in-house Architects, Interior Designers, and Project Managers. Nick brings over a decade of real estate expertise in the West London market, specialising in construction knowledge and the strategic packaging of investment opportunities to meet the diverse needs of our investors.

We are dedicated to enhancing property values through high-end renovations, enabling our partners and investors to leverage our extensive local expertise in areas like Fulham, Chelsea, Mayfair, Knightsbridge, and Belgravia. From the initial drawings to development, investment management, project management, and construction, #NU Cochrane guides our clients through every phase of property and infrastructure development. We aim to deliver excellence in full-service property development, inviting private investors and end-users to maximize value and achieve innovative, sustainable returns on refurbishments, basements, and new builds.

Cochrane Design, founded in 2004, extends our capabilities by providing comprehensive design, architecture, and development services for private clients, developers, hoteliers, and investors both in the UK and internationally. The collaboration between #NU and Cochrane Design has led to several high-profile projects, including homes for celebrities like Kylie Minogue, David Gandy, and other A-listers, showcasing our ability to meet the exquisite tastes and demands of discerning clients. Together, #NU Cochrane embodies a synergy of expertise and creativity, setting new benchmarks in the luxury property market.

Strengths

Our expertise enables us to identify and acquire undervalued sites with unique development potential. Leveraging our experience, we craft strategic designs and engage proactively with local planning authorities to enhance the site's development capacity. Our access to senior contacts in property auctions allows us to identify distressed properties before they hit the market, securing them at significantly lower prices to ensure a profitable purchase.

By managing due diligence, architecture, interior design, construction, and project management in-house, we significantly reduce our operational costs, eliminating the need for external outsourcing.

We conduct comprehensive feasibility studies for each potential property investment. This process includes financial modelling, profit forecasting based on current market conditions, and exploration of various architectural designs to maximise site value.

Our commitment to high-quality design not only differentiates our properties but also enhances their market value. This focus on excellence in design has consistently led to faster sales at higher prices compared to neighbouring properties.

Our integrated approach to construction and design allows for simultaneous progression of design and onsite work. By employing Design and Build Contracts, we achieve time and cost savings without sacrificing quality.

We utilise cutting-edge technology, including photorealistic visualisations and virtual reality presentations, to market properties before they are completed. This innovative approach shortens project timelines and engages potential buyers early in the process.

Q&A

How has Brexit affected the property market?

Brexit has opened quite a few opportunities in the property market- due to market instability there are more distressed sellers. We can buy properties much cheaper than before. This combined with low interest rates makes it an ideal buyer’s market. Typically our projects take 6-9 months so any property purchased right now should be ready to sell in a much stronger market once Brexit is decided in October. We are fairly confident that there will be an uplift in property value once the decision is made public. London typically underprovides housing- approximately there is a deficit 400000 homes. We also buy properties below current market value therefore even if we were to consider no drastic appreciation in value post Brexit we should still be profitable.

How long will it take to find the first project?

It can take anywhere between a week to a few months- we do not rush to suggest a property-we do thorough due diligence and only when we have found the right opportunity will we recommend it for purchase. We get offered approximately 10 projects a week through our contacts but not every project is suited. Once we have accessed the budget and criteria we are able to refine our options and suggest the appropriate project.

How do you work with investors profit split etc?

We typically target a 60-40 profit split ratio however we remain flexible based on the project. We reduce the tax by invoicing services throughout the project and reducing our profit share upon sale. This can vary from 20-30% + Invoices. We typically invoice the following services which are inhouse:

Finder’s Fee

Project management

Construction

Architecture

Interior Design

Visualisations

Our focus is to find a project where the investors get a return of 20-30% on their investment- once this has been calculated we retain flexibility in working out our share.

What if a property is unable to sell?

We always have a back-up plan. Incas the market takes a further downturn there is an opportunity to mortgage the asset and release the bulk of your investment. Typically we should be able to get a 70% mortgage on the developed value of the property- the interest only mortgage could vary between 3.5-4.9% per annum. This normally would be lower than the rent per month which the property can generate. This will allow you to hold an asset under the company and develop further projects with the initial investment.

What are the next steps?

We would recommend setting up the UK Company first- that takes 2 days. Simultaneously you would set up the Investors Company with 1-2 Directors. Following on from that a further 2-3 weeks to open the bank account in UK- they would require a letter of intent from the investors Company suggesting they are looking to invest approx. £1M to the UK Company as a JV. Once this account is open. We would then update the completion statement at company’s house and assign directors from the investors Company to the UK Company and adjust the shareholding based on our agreement. We can then complete mandates and add directors from the investors Company to the UK bank account. We would recommend that we could place an offer on a property once the UK bank account for the company is up and running. Beyond that we can slow down the purchase process till all other arrangements are in place.

What is the strategy?

The first property should be straight forward- not requiring a complicated planning application. Something that is ideally a paint and sell or a project that can be extended within permitted development. This will be a safer first project- proving that our model works. Once the first project is completed we have the option to take private finance to fund the next project. With the money from the sale of the first project with private finance we will be able to purchase two properties. Once you use private finance the ROI % increases significantly.

Typical private finance offer to us:

75% GDV

100% on construction

No entry fee.

No Exit Fee.

No minimum fixed term

Money released within 2 weeks.

For more information fill out the contact form to arrange a initial phone call.

Comments